Dalal Street

The market remained in control of bears for the third consecutive week ended April 29 but the losses were capped at less than half a percent amid nervousness in global counterparts and mixed March quarter earnings. Energy, healthcare, infra, technology and metal stocks weighed down the market, but buying in private banks, auto, and FMCG stocks curtailed losses.

The BSE Sensex lost 136 points to close the week at 57,061, and the Nifty50 fell 69 points to 17,103, but the pressure was more in broader markets as the Nifty Midcap 100 and Smallcap 100 indices have declined 1.4 percent and 2.7 percent respectively.

Overall, it was another week of consolidation for the market and the same kind of trend is expected to continue in coming holiday-shortened week too, given the ongoing geopolitical tensions, and elevated oil prices keeping inflation concerns intact, though the market would first react to auto sales numbers on Monday and as we move forward, would focus on Fed interest rate decision, LIC IPO, and economic data points, experts say, adding the stock specific action is expected to be more due to corporate earnings season.

“All these events coupled with the current earnings season can make markets choppy next week. If markets witness any major dips, investors are advised to use them to accumulate resilient stocks,” Yesha Shah, Head of Equity Research at Samco Securities said.

Meanwhile, Ajit Mishra, VP Research at Religare Broking also advised that investors shouldn’t look much into the short term fluctuations and keep a close watch on the earnings for cues.

The market will remain shut on Tuesday for Ramzan Eid.

Here are 10 key factors that will keep traders busy next week:

1) Earnings

As we will enter the fourth week of March quarter earnings season, nearly 200 companies will release quarterly earnings scorecard including prominent names like Reliance Industries, HDFC, Britannia Industries, Hero MotoCorp, Tata Steel, Titan Company, and Kotak Mahindra Bank.

In the broader space, Alembic Pharmaceuticals, Adani Wilmar, Castrol India, CG Power and Industrial Solutions, Devyani International, IDBI Bank, Inox Leisure, M&M Financial Services, Adani Enterprises, Godrej Properties, JSW Energy, KEC International, Symphony, TV18 Broadcast, Network18 Media, ABB India, Adani Green Energy, Adani Total Gas, CarTrade Tech, Equitas Small Finance Bank, Havells India, Tata Consumer Products, Adani Power, Adani Transmission, Blue Star, Ceat, Dabur India, Exide Industries, Happiest Minds Technologies, Indus Towers, Marico, TVS Motor Company, Voltas, Canara Bank, CSB Bank, Federal Bank, Tata Power Company, and Navin Fluorine International will also announce their quarterly earnings next week.

Also read – Buffett is back with one of his biggest buying sprees in years

2) LIC IPO

Apart from earnings, another key domestic event that everyone eyeing is the much-awaited initial public offering of insurance behemoth Life Insurance Corporation of India that will open for subscription on May 4, though the government has significantly reduced total issue size to around Rs 21,000 crore as it has decided to offload 3.5 percent of equity shares instead of 5 percent earlier. Earlier the street had expected the issue size of more than Rs 50,000 crore on the basis of 5 percent offload.

But still it is the largest IPO in the history of Indian capital markets, after Paytm that raised Rs 18,800 crore last year. The LIC offer will close on May 9. The anchor book, a part of QIB, will open for a day on May 2.

The price band has been fixed at Rs 902-949 per share for more than 22.13 crore shares offer. Employees and retail investors will get shares at a discount of Rs 45 per share, while the discount for policyholders will be Rs 60 per share to final issue price.

Most of experts expect the demand to the LIC IPO from every category of investors. Half of the offer is reserved for qualified institutional buyers, 15 percent for non-institutional bidders and the remaining 35 percent for retail investors.

Apart from LIC IPO, the share allotment of Campus Activewear and Rainbow Children’s Medicare will get finalised in later part of next week.

Also read – Buffett reveals big investments, rails against Wall Street excess at Berkshire meeting

3) US Fed Meet

Globally, all eyes would be on the interest rate decision by the US Federal Reserve. Most experts expect the US Fed to hike rate by 50 bps in its policy meeting to be held during May 3-4, which the markets seem to have already discounted, hence the commentary about future course of action including rate hikes will be keenly eyed and as a result of which the movement of US dollar index and 10-year treasury yield will be watched.

“It is widely expected that a 50 basis points hike is on the cards. As market participants attempt to read between the lines of Fed’s policy actions, any surprises can result in panic reactions in global markets. In addition, the unemployment rate in US will also be monitored closely,” said Yesha Shah.

Apart from FOMC meeting, focus will also be on Bank of England wherein experts expect 25 bps hike. “BOE has been raising interest rate since December and is expected to further hike by 0.25 percent next week. Currency movement will be dependent on BOE’s stance on future hikes as well as balance sheet reduction,” Ravindra Rao, VP – Head Commodity Research at Kotak Securities said.

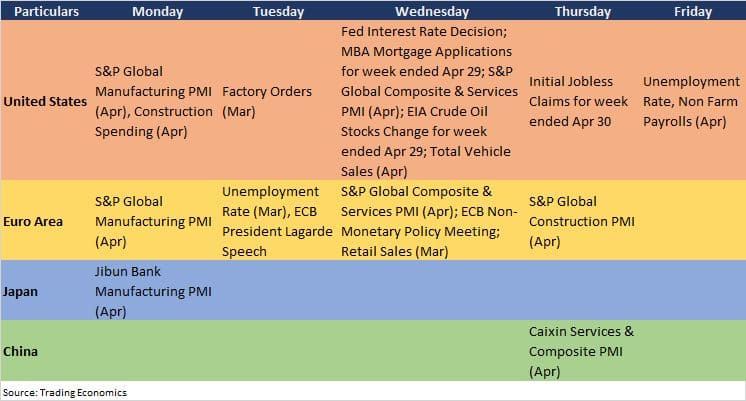

4) Global Data Points

Here are key global data points to watch out for next week:

5) Ukraine War

The war between Ukraine and Moscow that seems to be endless is expected to keep the equity markets volatile and make inflation concerns alive for more period of time, as reports indicated that the new phase of war is likely to have threatened by Russia, hence analysts feel both sides seem prepared for prolonged conflict that could extend beyond the battlefield, while the damage from the war that entered into nineth week is mounting on Ukraine.

“Moscow has escalated a slew of threats, including warnings of nuclear confrontation, energy crises and invasions of new territories. Meanwhile, the US and its allies are preparing new shipments of heavy weapons and military equipment to aid Ukraine,” CNBC report said, adding on Thursday, President Joe Biden requested Congress to provide $33 billion to Ukraine, including $20 billion for military equipment and assistance.

6) Oil Price Stays Above $100

Oil prices remained volatile with international benchmark Brent crude futures sustaining above $100 a barrel amid supply fears due to Ukraine war and demand worries on account of Covid-led lockdowns in China is going to be another factor that may keep markets rangebound and in a consolidative phase.

China, the world’s second largest economy, has been facing the issue of rising Covid cases and hence, there are lockdowns in several parts of the country, which raised concerns over its growth, global supply chains and oil demand, while CNBC reports quoting Reuters that Russian oil production could fall by as much as 17 percent this year as Western sanctions over Russia’s invasion of Ukraine hurt investments and exports.

Brent crude futures closed at $107.4 a barrel, up seven-tenth of a percent, while natural gas prices also remained elevated, rising nearly 11 percent during the passing week on supply concerns relating to Russia.

Russia cut natural gas supply to Poland and Bulgaria over their hesitance to make gas payments in rubbles. “Russia’s move highlighted that energy supply risks are far from over. Market players are now trying to assess if European Union may take measures to restrict Russian energy exports to the region. Germany has already expressed support for phased in ban on Russian crude exports,” Ravindra Rao of Kotak Securities said.

7) FII Selling

The FII outflow is another factor that keeping a cap on the markets upside, though domestic institutional investors have consistently been trying hard to compensate the FII outflow. Experts remain confident that FII flow will be back to India in second half of 2022 given the economy is much more resilient.

FIIs have net sold nearly Rs 11,500 crore worth of shares, taking the total monthly net outflow to Rs 40,652 crore in April. They have been heavy net sellers for seventh consecutive month amid policy tightening by Federal Reserve, while US 10-year treasury yields closed the week at 2.89 percent against 2.89 percent on week-on-week basis, and US dollar index, which measures the value of US dollar against world’s leading six currencies, ended higher by 1.96 percent at 103.21.

On the contrary, DIIs have net purchased shares worth Rs 9,700 crore during the week and their monthly buying stood at nearly Rs 29,900 crore for April.

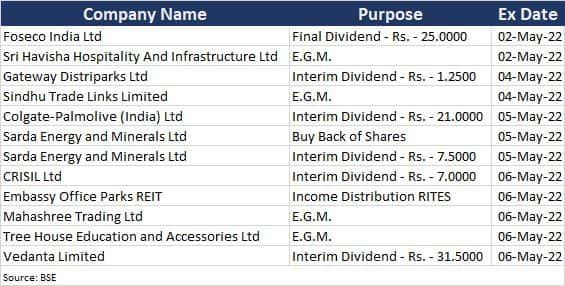

8) Economic Data Points and Corporate Action

Here are key corporate actions taking place in the coming week:

On the macro front, Manufacturing PMI data for April will be released on Monday, while Services & Composite PMI data is scheduled to be released on Thursday.

Apart from that, foreign exchange reserves for the week ended April 29, and bank loan & deposit growth for fortnight ended April 22 will be announced on Friday.

9) Technical View

The Nifty50 has formed large bearish candle on Friday as the index lost all its gains in last hour of trade to close the day down by 0.8 percent, while there was bullish candlestick formation on the weekly basis as the index closed higher than opening levels though the week ended volatile week down by 0.4 percent.

Overall the trend indicated that the index has been in a broad consolidation zone of 16,800-17,400 for more than couple of weeks, which needs to be decisively broken on either side for directional move, experts say,

“A small body of positive candle was formed on the weekly chart with long upper shadow. After the formation of Doji pattern in previous week, the market showing inability to sustain the upside could signal more weakness ahead,” Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

He further said the pattern of one day up and down continued in the market within a broad high low range of 17,400-16,800 levels.

“The sharp intraday downward reversal of Friday from near upper range could signal probability of Nifty revisiting the lower range of 16,900-16,800 levels by next week. The possibility of sharp downside breakout of the said range and also a significant lower support of 16,800 is getting higher in the near term,” he added.

10) F&O Cues

Option data indicated that the Nifty50 is likely to trade in a wider range of 16,700-17,600 levels in coming days. Maximum Call open interest was seen at 18,000 strike followed by 17,300 & 17,500 strikes, with Call writing at 18,000 strike then 17,100 & 17,300 strikes, while maximum Put open interest witnessed at 17,000 strike followed by 17,100 & 16,800 strikes, with Put writing at 17,100 strike then 17,300 & 17,000 strikes.

“The Nifty is starting the May series with one of the lowest ever open interest with just 8.5 million shares. FIIs open interest has declined sharply at the inception of the series ahead of Fed meet next week and while they are still marginally short, fresh accumulation of open interest is likely to trigger fresh up move in the index,” said ICICI Direct which, going ahead, believes that the Put base placed at 17,000 strike should remain crucial support for the index.

The volatility remained on the higher side, which was another reason for nervousness at Dalal Street. India VIX rose by 5.8 percent during the week to 19.42 levels on Friday, which experts feel needs to fall sharply to give comfort to bulls.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

from WordPress https://ift.tt/xFzSy2B

via IFTTT

No comments:

Post a Comment