#CNBCTV18Exclusive | Working on bank insurance in a big way. Will report big double-digit growth in non-par biz going forward, says Mangalam Ramasubramanian Kumar, Chairperson of @LICIndiaForever

#LIC #LICIPO #licipoallotment #LICListing #licipolisting pic.twitter.com/wC9H5bJNM4— CNBC-TV18 (@CNBCTV18Live) May 17, 2022

Vinod Nair, Head of Research at Geojit Financial Services on LIC listing:

The subdued listing of LIC is in-line with expectations in context to the drop in market dynamics from the opening of the IPO to the listing date. The listing price has fallen in tandem with the fall of insurance sector valuations, maintaining the discount of about 70% to the industry’s average. Positively, the stock was brought at the dip. We believe that LIC is a decent investment opportunity in the short to medium-term considering its strong market presence, improvement in future profitability due to the changes in surplus distribution norms and strong sector growth outlook. LIC can perform well when we have a bounce in the market and positive performance in the insurance sector.

#CNBCTV18Exclusive | Did our best to offer a very high value company at a fair price. Have to be mindful of preparing the roadmap going forward, says Tuhin Kanta Pandey @SecyDIPAM of LIC #licipoallotment #LICListing #LICIPO #licipolisting #LIC pic.twitter.com/MkX4KaOrfJ

— CNBC-TV18 (@CNBCTV18Live) May 17, 2022

Vinod Nair, Head of Research at Geojit Financial Services

The subdued listing of LIC is in-line with expectations in context to the drop in market dynamics from the opening of the IPO to the listing date. The listing price has fallen in tandem with the fall of insurance sector valuations, maintaining the discount of about 70% to the industry’s average. Positively, the stock was brought at the dip. We believe that LIC is a decent investment opportunity in the short to medium-term considering its strong market presence, improvement in future profitability due to the changes in surplus distribution norms and strong sector growth outlook. LIC can perform well when we have a bounce in the market and positive performance in the insurance sector

#CNBCTV18Exclusive | Working on bank insurance in a big way. Will report big double-digit growth in non-par biz going forward, says Mangalam Ramasubramanian Kumar, Chairperson of @LICIndiaForever

#LIC #LICIPO #licipoallotment #LICListing #licipolisting pic.twitter.com/wC9H5bJNM4— CNBC-TV18 (@CNBCTV18Live) May 17, 2022

B Gopkumar, MD & CEO, Axis Securities

While LIC debuted at a slight discount to its issue price, investors should not look to exit at current levels and hold the stock from a medium to long-term perspective. We believe LIC continues to be a solid bet in the long run as it is a play on the growth story of the under-penetrated life insurance industry. Its sustained market leadership position, robust pan-India distribution network, and shifting focus towards profitable products, thus supporting margins and improving persistency ratios, will collectively make LIC an attractive pick from a long-term perspective.

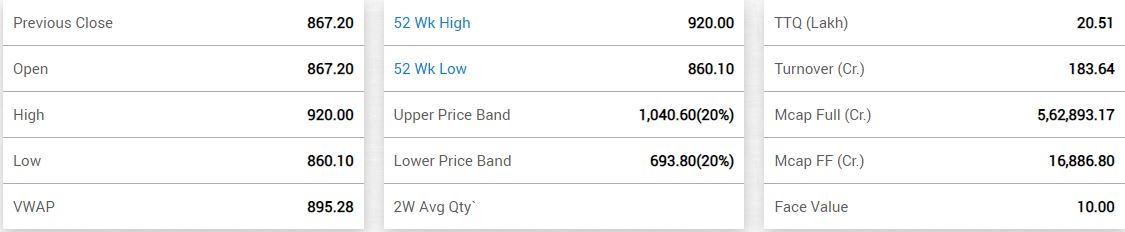

Life Insurance Corporation of India was quoting at Rs 887.35, down Rs 61.65, or 6.50 percent. It has touched an intraday high of Rs 920.00 and an intraday low of Rs 860.10.

Mohit Ralhan, Managing Partner, TIW Capital Group, on the LIC IPO being listed on the stock exchanges:

The 8% lower debut of LIC shares is a commentary on the current state of global markets rather than the company itself. In terms of subscription, the LIC IPO was extremely successful given the fact that it was the biggest IPO of India. LIC has a solid business, trusted brand, and market leadership in an underpenetrated insurance market. In FY-21, LIC’s market share was about 75% for individual policies and 81% for group policies. It is the top life insurance company by a wide margin. The insurance industry in India is growing at an annual rate of about 15% and the growth is expected to sustain over a long period of time given that insurance penetration in India is a meagre 3.2% which tends to be more than 8% for developed economies and it is about 5% in China. LIC is a typical blue-chip company which is expected to give steady returns over a long period of time and therefore returns over a day is not relevant. It is expected to remain quite attractive for investors.

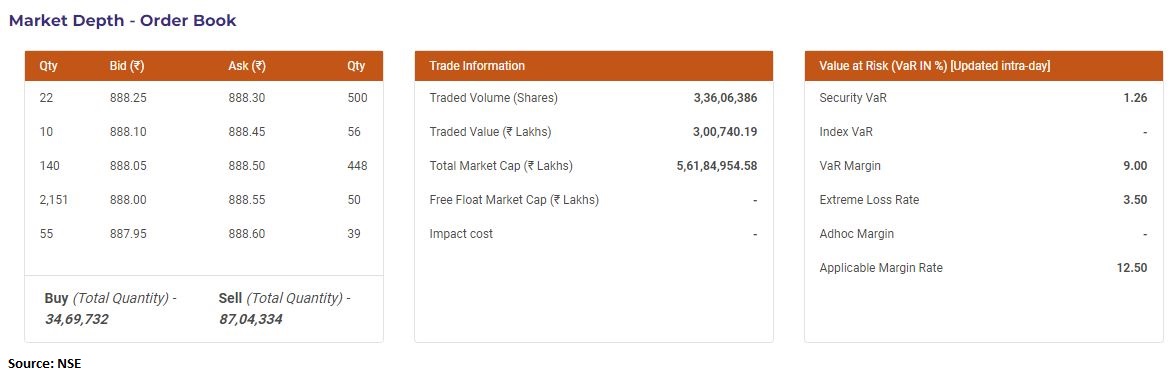

LIC market depth – order book

@LICIndiaForever makes debut on stock exchanges at ₹865/share, a discount of 9% against the issue price of ₹949/share#LICListing #LIC #IPO #LICIPO #stockmarket #IPOCornerhttps://t.co/89WtjM0wyu

— CNBC-TV18 (@CNBCTV18News) May 17, 2022

Mohit Nigam, Head – PMS, Hem Securities on LIC listing:

As observed, the majority of big IPOs have not given a strong listing debut gains. Considering previous trends, LIC has continued to take the same path with listing at a discount of 8.8% from 949 to 872 at NSE on its listing day and is currently trading at Rs 900-905 levels. We believe that personal savings and awareness regarding insurance will increase enabling the sector to outperform in the long run and will indirectly benefit LIC as it is the market leader in this sector. We feel long term investors should continue to hold the scrip while short-term investors can wait to enter at a lower price.

from WordPress https://ift.tt/E61ncwS

via IFTTT

No comments:

Post a Comment